Today I saw a piece in the Guardian by John Vidal – Engineers race to design the world’s biggest offshore wind turbines, with some nice graphics of a Horizontal Axis Wind Turbine, reproduced below here;

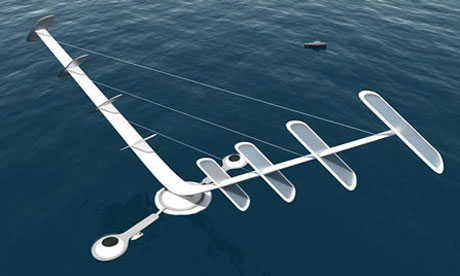

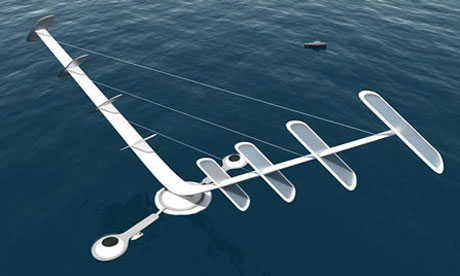

This looks awfully similar to another company I came across 5 years ago in 2005, Theodore Bird’s Aerogenerator from Windpower Ltd. – also published in the Guardian in 2008 and reproduced here;

And that’s because it’s the same company but the first image suggests a much simpler design with fewer components which makes sense in these straitened times.

Offshore wind really has a lot of problems like;

- double the installed cost per megawatt to onshore (£3m v. £1.5m)

- higher maintenance costs – try getting out to that non-performing turbine in choppy sea conditions

- the total lack of jack-up barges to install them in the first place

- there’s no race to finance it – don’t believe the hype

Now back to the theme of the post. I’ve just been reading an excellent book, False Economy by Alan Beattie. The phrase that sticks in my mind is path dependence. Path dependence, you should understand, is a series of choices made by a species or a company or a person, that can ultimately leads to a dead end. That argues Beattie is what happened to that poster image of the WWF, the Giant Panda. A bear that is incompetent at consuming and reproducing unless in a very narrow environment where it chews bamboo, a low nutrient plant for up to 16 hours a day. Pandas says Beattie, are useless. No wonder they need protection.

Arguably, worldwide, wind turbine manufacturers are stuck on their own Panda-like, subsidy-rich path dependence, the Horizontal Axis wind turbine, classically understood as this;

There’s actually been no serious attempt to build them any bigger than 5 MW in scale since 2005 and most investors plump for 3 MW turbines. They have reached an evolutionary dead-end. So what’s the alternative?

There’s actually been no serious attempt to build them any bigger than 5 MW in scale since 2005 and most investors plump for 3 MW turbines. They have reached an evolutionary dead-end. So what’s the alternative?

The case for horizontal axis wind turbines is that they potentially offer;

i) Longer lifespans – up to 40 years rather than 15-25

ii) Higher load factor

iii) Quite low cut-in speeds and much higher cut-out speeds

iv) And much lower financing costs

The proof though is in the pudding – I want to see a big one in action delivering the goods. Let’s not forget that the learning curves of offshore wind 7 years ago were meant to be costs coming down, not doubling as they have done.

And whatever the industry, always be suspicious and ask many questions of someone confidently forecasting falling costs over time thanks to an increase in production – but for the computer and auto industry, it usually doesn’t happen.

There’s actually been no serious attempt to build them any bigger than 5 MW in scale since 2005 and most investors plump for 3 MW turbines. They have reached an evolutionary dead-end. So what’s the alternative?

There’s actually been no serious attempt to build them any bigger than 5 MW in scale since 2005 and most investors plump for 3 MW turbines. They have reached an evolutionary dead-end. So what’s the alternative?